Our Company

Cherokee Nation Businesses is the tribally owned holding company of Cherokee Nation — the largest Native American tribe in the U.S. Our mission is to grow and strengthen Cherokee Nation’s economy through innovation, diversification and job creation. We employ more than 10,000 people worldwide, working within 45 companies across three business units that generate nearly $2 billion in annual revenue. With our continued growth, we’re committed to the success of Cherokee Nation Businesses and the citizens of Cherokee Nation.

Executive Leadership Team

CNB is an independent holding company, governed by a board and led by an experienced executive leadership team.

Executive Chairman

Bill John Baker was elected to two terms as Principal Chief of Cherokee Nation, serving from 2011 to 2019. Prior to that, Baker spent 12 years on the Council of the Cherokee Nation. In those roles, he worked with many local, state and federal government officials on infrastructure, health care and economic initiatives. As executive chairman of Cherokee Nation Businesses, Baker serves as an ambassador to the...

moreChief Executive Officer

Chuck Garrett has more than 25 years of experience in the legal, gaming and commercial real estate industries, holding senior management roles at several large corporations. Garrett joined CNB in 2013, and he was promoted to executive vice president in 2015. As CNB’s chief executive officer, Garrett works with the board of directors to set the vision, direction and strategy for the company.

morePresident, Cherokee Nation Entertainment

Mark Fulton has more than 30 years of experience in the gaming and hospitality industry. Before joining Cherokee Nation Businesses in 2007, Fulton oversaw the purchase, rebranding and operations of Harrah’s Tunica and Bally’s Tunica for Resorts and Destinations Inc. in Mississippi. Fulton’s immediate responsibilities are leading the casino, racing, hotel and retail operations for CNB,...

morePresident, Cherokee Federal

Steven Bilby leads a team of federal contracting professionals that works around the globe to help solve issues in immigration, national security, intelligence, cybersecurity, health care and logistics. Bilby joined Cherokee Nation Entertainment (formerly Cherokee Nation Enterprises) in 2002, where he served as vice president and chief information officer from 2005 to 2009. In his most recent role,...

moreChief Human Resources Officer

Stephanie Cipolla joined Cherokee Nation Businesses in 2016 and currently oversees human resources for the company. Cipolla is responsible for HR strategy, analytics, compensation, benefits, information systems (HRIS) and talent management. Before joining CNB, she spent 25 years with the energy company Williams and served as its vice president of human resources.

moreChief Financial Officer

Doug Evans oversees all of Cherokee Nation Businesses’ fiscal matters as its chief financial officer. Evans brings more than 35 years of experience in financial reporting and analysis, treasury management, operational budgeting, strategic capital planning, problem solving and supply-chain management. He works closely with the executive leadership team and the board of directors in setting strategic...

moreChief Legal Officer

Robert Huffman joined Cherokee Nation Businesses in 2004. Throughout that time, Huffman has served as the company’s chief legal officer and a member of the executive leadership team. A practicing attorney for 42 years, Huffman holds a Martindale-Hubbell AV Preeminent Peer Review Rating. He has extensive experience in legal matters, including corporate, regulatory and gaming law.

moreSVP, COO, Cherokee Nation Cultural & Economic Development

Molly Jarvis has more than 25 years of experience in casino and brand marketing. Jarvis was responsible for developing, implementing and managing the overall marketing and sales strategy for CNB, including the brand transition from Cherokee Casino Resort to Hard Rock Hotel & Casino Tulsa in August 2009. Prior to joining CNB in 2002, she held several...

moreSenior Vice President & Special Counsel

Todd Hembree served as the attorney general of Cherokee Nation from 2012 to 2019. As attorney general, Hembree negotiated state-tribal compacts, settled a 175-year old treaty-rights dispute and initiated a first-of-its-kind lawsuit against the opioid industry. For twelve years prior, he was the attorney for the Council of the Cherokee Nation, for which he developed rules of procedure...

moreSenior Vice President & General Counsel

Tim Baker has practiced law since 1973. Baker has been designated a Martindale-Hubble AV lawyer for more than 35 years, and he has been recognized in the top 1% of practicing lawyers. Since 2015, he has served as general counsel for Cherokee Nation Businesses. In addition to his private practice, he was the city attorney for Hulbert, Oklahoma, legal counsel for Tahlequah City...

moreSenior Vice President, Government Relations

Kim Teehee is director of government relations for Cherokee Nation and senior vice president of government relations for Cherokee Nation Businesses. In 2019, Cherokee Nation Principal Chief Chuck Hoskin Jr. named Teehee as the tribe’s first delegate to the U.S. House of Representatives. She previously served President Barack Obama as the first-ever senior policy advisor for Native...

moreCNB Board of Directors

Shaun Shepherd (Chairman)

Bob Berry

Lynna Carson

Chris Carter

Dan Carter

Gary Cooper

Laura Dishman

Buck George

Bill Hickman

Jerry Holderby

Barry Reynolds

Julie Eddy Rokala

Brent Taylor

Brenda Thompson

Deacon Turner

Michael Watkins

Tommye Wright

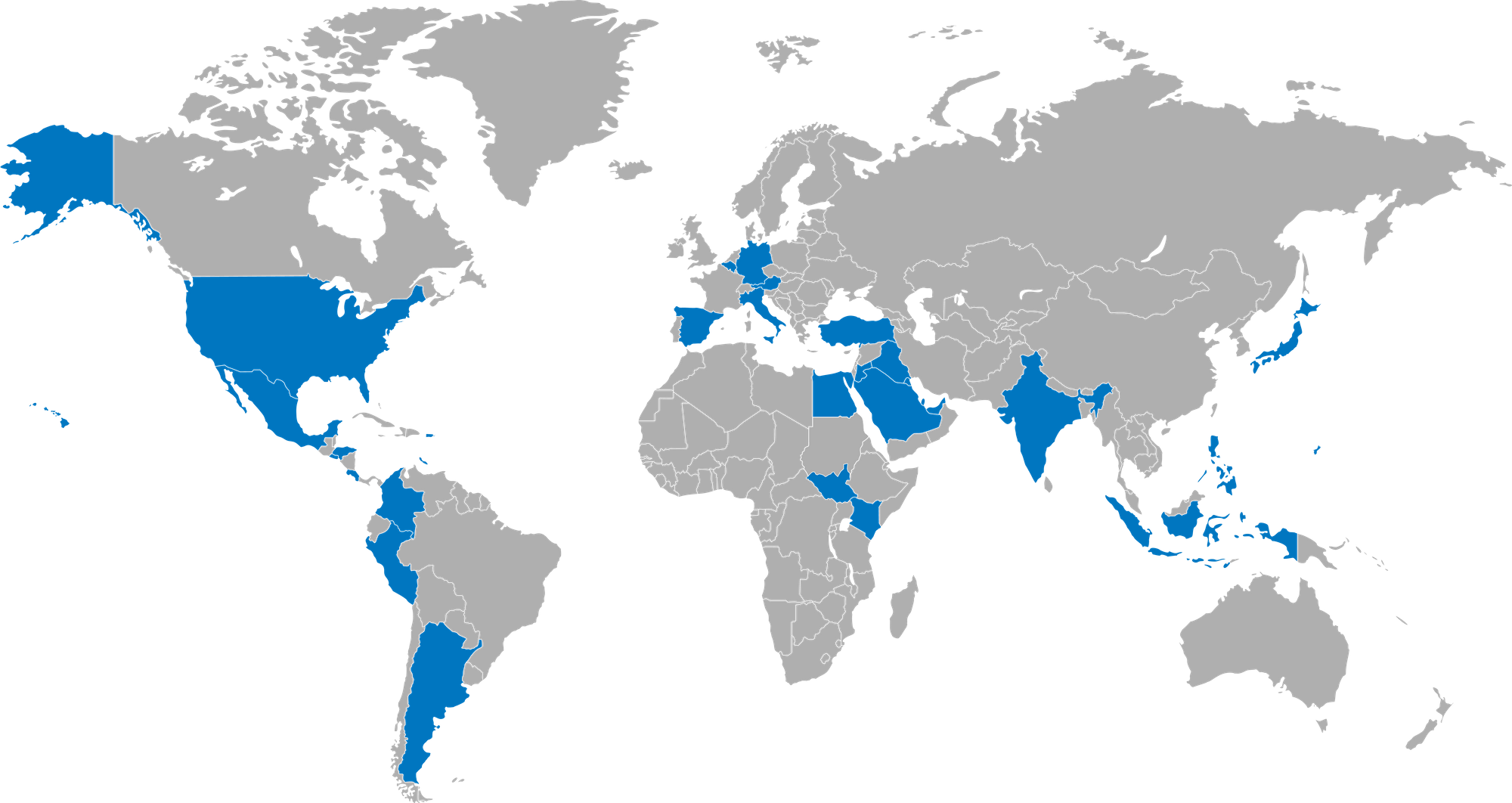

Office Locations

- Arlington, Virginia

- Atlanta, Georgia

- Claremore, Oklahoma

- Denver, Colorado

- Dover, Delaware

- Fort Gibson, Oklahoma

- Grove, Oklahoma

- Huntsville, Alabama

- Pryor, Oklahoma

- Ramona, Oklahoma

- Roland, Oklahoma

- Russellville, Arkansas

- Sallisaw, Oklahoma

- San Antonio, Texas

- South Coffeyville, Oklahoma

- Stilwell, Oklahoma

- Tahlequah, Oklahoma

- Tulsa, Oklahoma

- West Siloam Springs, Oklahoma

- International Offices:

- Abu Dhabi, United Arab Emirates

- Baghdad, Iraq

Join Our Team

Cherokee Nation Businesses invests in the brightest, most talented individuals to ensure our brands are successful.